Seamless UK Company Formation: A Guide for International Entrepreneurs

The United Kingdom has long been a magnet for global business, known for its stable economy, robust legal framework, and innovative spirit. For foreign entrepreneurs looking to expand their horizons, forming a company in the UK presents a wealth of opportunities. This guide will walk you through the essentials, making the process feel less daunting and more exciting.

Why Choose the UK for Your Business Venture?

The UK offers compelling reasons for international entrepreneurs to establish a presence. It’s not just about a prestigious address; it’s about being part of a dynamic global hub.

Access to a Thriving Market

Setting up a company in the UK provides direct access to one of the world’s largest consumer markets and serves as an excellent gateway to Europe and beyond. The UK’s strong trade links and strategic geographical position make it an ideal base for international operations.

Business-Friendly Environment

The UK government actively supports businesses with clear regulations, competitive corporation tax rates, and various incentives for growth and innovation. The legal system is highly respected, providing certainty and protection for your investments.

Prestige and Credibility

Operating a UK-registered company can significantly enhance your business’s international reputation and credibility. It signals professionalism and trustworthiness to clients, partners, and investors worldwide.

Understanding Company Structures for Foreign Entrepreneurs

Before you dive into the formation process, it’s crucial to understand the most common types of companies available in the UK.

Private Company Limited by Shares (Ltd)

This is by far the most popular choice for businesses in the UK, including those started by foreign entrepreneurs. Key features include:

- Limited Liability: The personal liability of shareholders is limited to the amount unpaid on their shares.

- Separate Legal Entity: The company is distinct from its owners, meaning it can enter contracts, own assets, and incur debts in its own name.

- Flexibility: Relatively straightforward to set up and manage.

Limited Liability Partnership (LLP)

LLPs combine the flexibility of a partnership with the limited liability of a company. They are often chosen by professional service firms, but any two or more people looking to run a business together with limited liability can form an LLP.

Key Requirements for Foreign Entrepreneurs

Fortunately, the UK has made company formation quite accessible for non-residents. You do not need to be a UK resident or citizen to form a company.

Registered Office Address

Every UK company must have a registered office address in the UK. This is where official correspondence from Companies House and HMRC (Her Majesty’s Revenue and Customs) will be sent. Many foreign entrepreneurs use professional services that provide a registered office address.

Directors and Shareholders

- Directors: A minimum of one director is required. There are no residency requirements for directors.

- Shareholders: A minimum of one shareholder is required. The director and shareholder can be the same person.

Company Secretary (Optional)

For a private limited company, appointing a company secretary is optional. If you choose not to have one, the responsibilities typically fall to the directors.

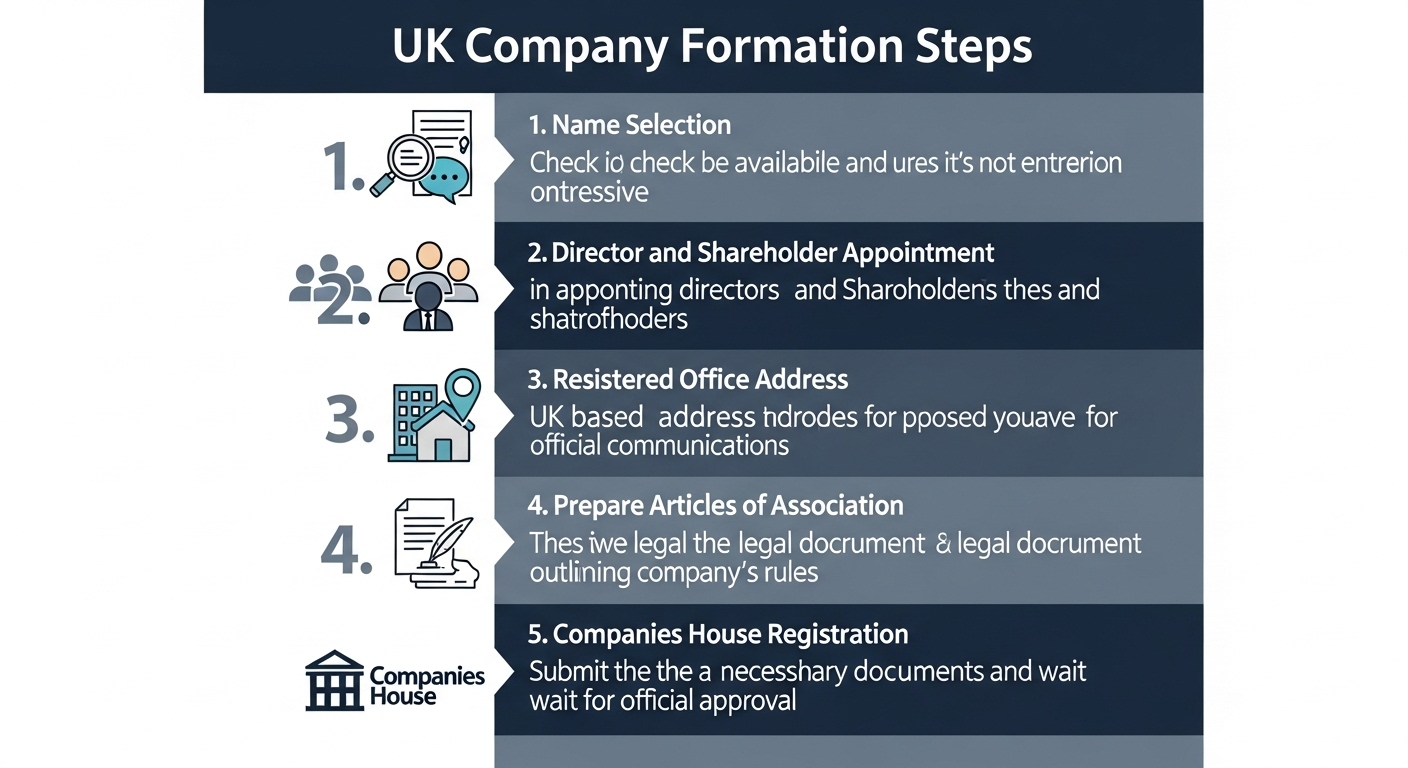

Step-by-Step UK Company Formation Process

Forming your company is a structured process that can often be completed efficiently, especially with the right guidance.

- Choose a Company Name: Select a unique name that isn’t already registered or too similar to existing names. You can check availability via the Companies House website.

- Appoint Directors and Shareholders: Decide who will hold these roles. You’ll need their personal details, including full name, address, date of birth, and nationality.

- Prepare the Memorandum and Articles of Association: These are the fundamental documents governing the company. The Memorandum states the subscribers (first shareholders) intend to form a company, while the Articles set out the rules for running the company.

- Establish a Registered Office Address: Secure a valid UK address for official communications.

- Register with Companies House: Submit all required documents and information to Companies House. This can be done online, often resulting in incorporation within 24 hours.

- Register for Corporation Tax: Once your company is incorporated, HMRC will automatically be notified. However, you’ll need to register for Corporation Tax within three months of starting to do business.

Post-Formation Responsibilities

Incorporation is just the beginning. To ensure your company remains compliant, you’ll have ongoing obligations.

- Annual Accounts: You must prepare and file statutory annual accounts with Companies House and HMRC.

- Confirmation Statement: An annual declaration confirming your company’s information (directors, shareholders, registered office) is up-to-date.

- Corporation Tax Returns: File a company tax return and pay any Corporation Tax due.

- Bank Account: While not a legal requirement for formation, opening a UK business bank account is essential for operations. This can sometimes be challenging for non-resident directors, but several fintech solutions and traditional banks offer services for international clients.

Ready to Launch?

Forming a company in the UK as a foreign entrepreneur is a straightforward process, offering immense benefits for global business expansion. With careful planning and attention to detail, you can quickly establish your presence and begin leveraging the UK’s thriving economic landscape. Don’t hesitate to seek professional advice to ensure a smooth and compliant setup tailored to your specific needs.